Some analysts have already praised MGM Resorts International's (NYSE: MGM) announcement earlier this week that its LeoVegas unit is purchasing the US iGaming and sportsbook activities of Tipico Group for an undisclosed amount.

Despite the fact that the Tipico acquisition is more about strengthening technology capabilities than expanding market share, Kim Noland, an analyst at Gimme Credit, called the transaction "a key element" of MGM's digital strategy and noted that the operator's efforts in that area are beginning to yield some benefits.

"MGM’s sports betting and digital offerings are beginning to provide a profitable addition to its luxury international casino resorts presence and could be a growth tailwind going forward,” wrote the analyst in new report to clients.

When the deal is completed in the third quarter, Tipico will eventually stop operating in the US, and part of its management, technology, and trading professionals will join LeoVegas.

MGM Might Use Tipico Purchase to Expand Digitally Abroad

When MGM paid over $600 million to acquire LeoVegas in 2022, it was evident that the gaming firm wanted to expand its digital reach outside of the United States. In that effort, the soon-to-be-acquired Tipico technology might be helpful.

Investors should take note of MGM's global objectives for its digital gaming division since the operator isn't constrained by its affiliation with Entain outside of the United States. BetMGM is a 50/50 joint venture between MGM and Entain in this country; however, MGM outside of the US is not subject to the same competition constraints.

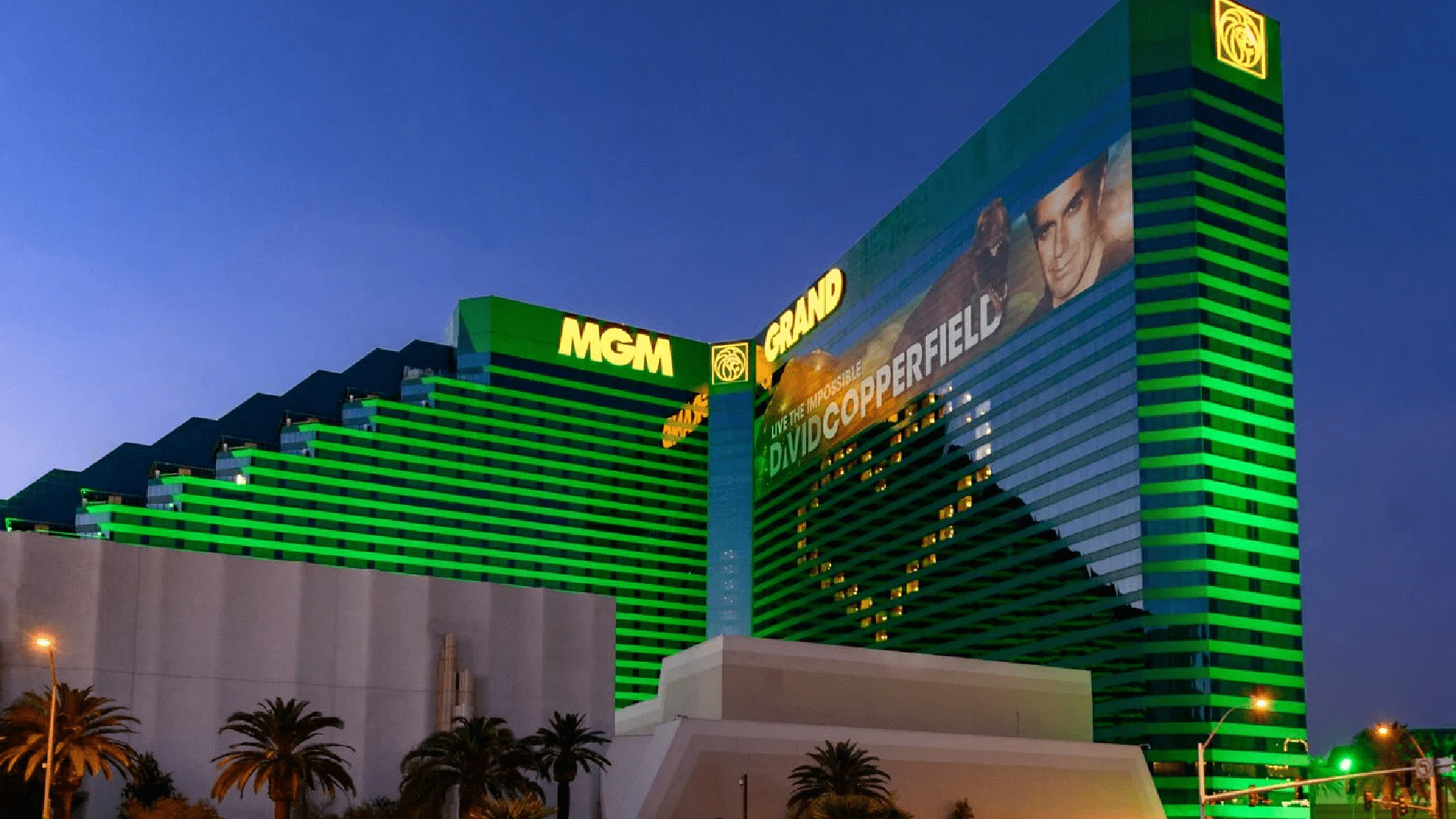

“The Tipico technology will help to scale MGM/LeoVegas across multiple jurisdictions and can be deployed internationally where the BetMGM joint venture doesn’t have exclusivity,” added Noland. “In addition, MGM recently joined a partnership with Playtech to offer live casino content, streamed directly from the gaming floors of Bellagio and MGM Grand in Las Vegas, to international regulated markets, with an option for entrance into U.S. markets in the future.”

The analyst said that MGM's iGaming division is expanding generally, but it's possible that the Playtech live gaming operation will run into regulatory obstacles.

Possibility of MGM Bonds

Although MGM's stock has increased by about 15% this month, income investors may wish to consider the operator's 2027-maturing bonds as the company does not provide a significant dividend. According to Noland, that issue "outperforms" and has a yield-to-worst of about 6%.

She saw that the bond's bullish outlook is supported by the gaming company's free cash flow creation and other strong fundamentals.

“Our free cash flow estimate (adjusted EBITDAR less cash rent, interest, taxes and capex) is based on management’s guidance of $850 million capex and totals near $1.5 billion. In addition, MGM’s stock repurchases are significant ($511 million in the first quarter) and its remaining authorization is a hefty $1.7 billion,” concluded the analyst.